CAR BODY REPAIR FINANCE OPTIONS

EASR HAVE PARTNERED WITH BUYLINE FINANCE

How does Buyline finance work?

When used responsibly finance is a fantastic way to spread the cost of your car repairs and can help you get what you want today.

It is easy to apply as we have partnered with Buyline to help you through.

If you are in our workshop or on the phone, just let us know

you are considering our finance packages and we can talk you through the

options. You can complete an application with us in the workshop or at home at your convenience.

The quick application form takes no more than a few minutes to complete, and you’ll receive an instant decision

Check your eligibility

Before you apply please note you will only be considered for finance, if you:

- Must be a UK resident

- Are over the age of 18

- Have a valid email address and telephone number

- Hold a UK bank account

Finance is subject to application, your financial circumstances and your borrowing history.

Our payment options

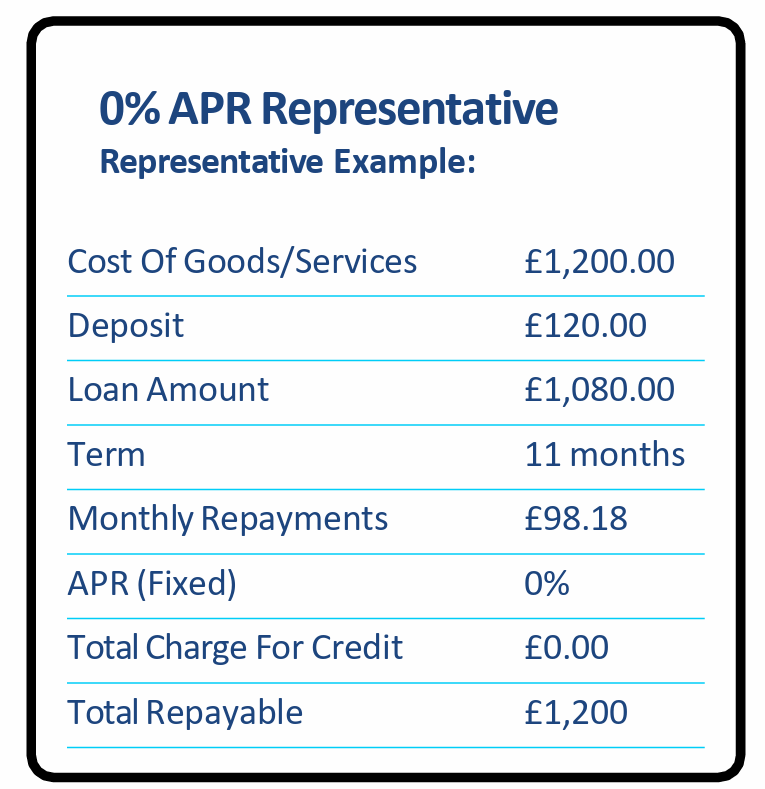

We offer a range of interest-free finance offers to help you spread the cost of your payments over 6, 9, 10 or 11 months.

The value of your loan needs to be a minimum of £250 after any deposit with a maximum loan of £25,000.

You can choose to pay a deposit from nothing to 50% of the value of your goods or services.

Split your car repair costs at EASR Bodyshop

If you would like to learn more about our car repair finance options, get in touch with our team today.

EASR Ltd is a credit broker, not a lender. We do not charge you for credit broking services. We will introduce you to loan products provided by Buyline Ltd.Buyline Ltd is authorised and regulated by the Financial Conduct Authority. Firm Reference Number 805162. However, credit agreements that are interest-free and less than twelve months are unregulated. Registered office: B12 Elmbridge Court, Cheltenham Road East, Gloucester, GL3 1JZ. Registered at Companies House Number: 11223350.